From a dusty road to a bustling city

It was 2016, and I was walking along a dusty road in rural Kenya. I saw what you might expect in rural Kenya, the sound of sheep bleating, merchandise laid out on creaking and worn-out tables in a village market. But what surprised me was instead of paying with cash, buyers and sellers pulled out their phones and paid for goods digitally. It was mobile banking, but in the middle of rural Kenya, not in the middle of Silicon Valley, it was M-Pesa.

M-Pesa pioneered mobile money in Kenya, before fintech was even a thing. In 2006, only 26.7% of the population had access to financial services. By 2016, it was 75.3%. Through the basic mobile phone, millions of Kenyans in urban cities and rural villagers had access to frictionlessly remit money to friends and family, pay for goods, borrow and securely store their money. Now more than half of Kenya's GDP runs through M-Pesa. It's a story of economic empowerment that changed the trajectory of a nation.

It’s a story that led me to ClearScore where my co-founders and I had front-row seats to the consumer credit industry. An industry in need of a serious shakeup.

Bringing a 1960s product into the 21st century

Credit cards were born in a fascinating time. It was the 1960s and the brand "Bank Americard" launched one of the first general-purpose credit cards. Credit cards were a truly revolutionary alternative to cash and instalment loans with wide merchant acceptance and innovative features like interest-free periods. But sixty years later, we haven't seen much change. Even today’s credit card loyalty programs reflect the American Airline credit card loyalty program that started in 1981.

Credit cards have become a game of deception between consumers and banks. With sign-up bonus offers, 0% balance transfer offers, attractive minimum monthly repayments, hidden fees, it’s a game of who can outsmart who: consumers or banks. It’s no surprise that more time in banks is spent on optimising their credit card portfolio profitability than creating financial products that genuinely work for consumers.

We think there’s a better way.

Building the financial membership of the future

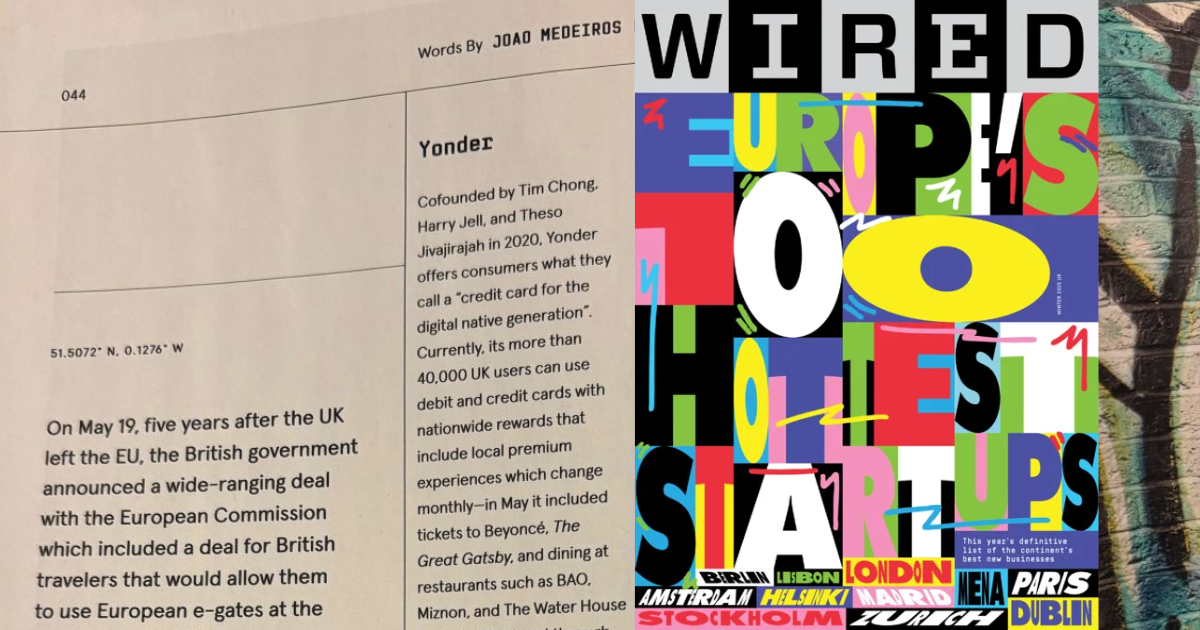

At Yonder, we’re starting our journey by rebuilding the modern credit card from the ground up. We're building a card that’s truly a key to the city – with an experience that's beautiful and uncompromisingly fair. A credit card that looks at people’s complete financial picture, and one that rewards consumers with the best of their city. We've built Yonder to be the perfect companion to all of life’s adventures, whether it’s in a bustling city or exploring the best dining experiences abroad.

We’re creating a financial membership that goes beyond a card – one that's built around life’s most memorable experiences, empowering our members to frictionlessly spend, borrow, invest and save. We want to build a financial experience not bound by national borders, but one that just works wherever consumers are in the world.

.jpeg)

A world where financial services are fair, and the stress of debt is eliminated for everyone

I believe that no other industry is better placed to empower people than financial services. I know, because it happened right in front of me in Kenya. But it’s lost its way, it’s become an industry that's single-mindedly focused on maximising quarterly earnings, and it doesn’t work for consumers.

But what if financial products were intuitive, easy to understand and truly worked for consumers? What if financial products offered fair value exchange, creating value for both consumers and businesses alike? What if financial services treated consumers with dignity and respect, rather than as a row on a spreadsheet? What if we eliminated debt advice because financial products never let consumers spiral into problem debt?

That’s a world we want to build at Yonder.

Join us on our adventure

You can apply to be a Founding Member today to help us test things out before we open up later this year. Please remember that with any form of credit, you should only ever spend what you can afford to pay back, and you'll need to make at least your minimum payment on time every month or it can impact your credit rating.

.png)

.png)